Title Commitments 101: What Real Estate Agents and Lenders Need to Know

A title commitment is a crucial part of any real estate transaction. Here’s what you need to know:

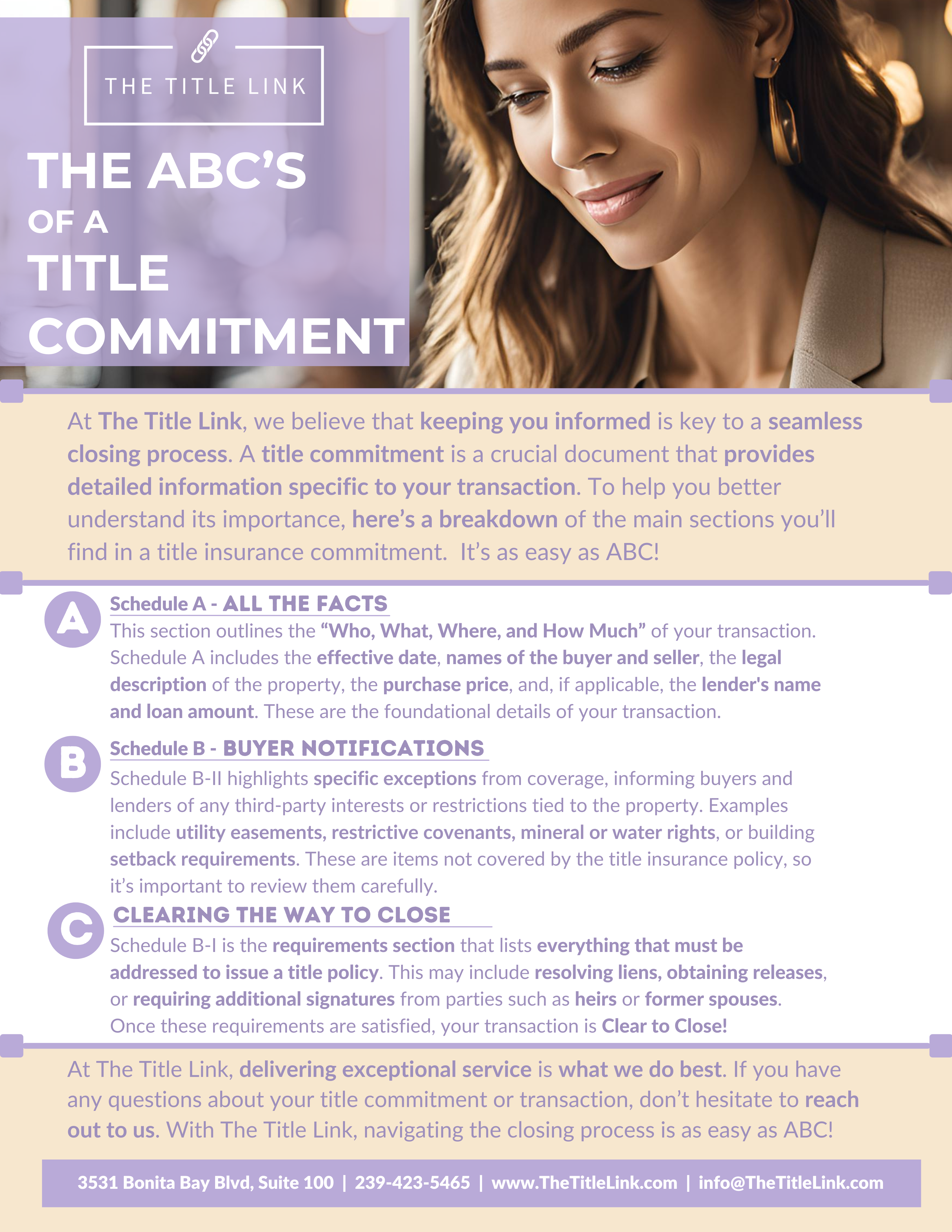

1. What Is a Title Commitment?

A title commitment is a document issued before closing that outlines the conditions for insuring the property title. It serves as a promise from the title company to issue a title insurance policy once all requirements have been met. Understanding this document can help real estate agents and lenders navigate potential title concerns before closing.

2. Key Sections to Review – Real estate agents and lenders should pay close attention to:

- Schedule A: This section provides the fundamental details of the transaction, including the names of the parties involved, the legal description of the property, and the title insurance policy amount.

- Schedule B: This outlines any exceptions and requirements for issuing the final title policy. It includes any easements, restrictions, or liens that could affect the property.

3. Common Issues That Can Delay Closing

Title defects, unpaid liens, and boundary disputes are common hurdles in real estate transactions. If left unresolved, these issues can delay or derail a closing. A title commitment helps by identifying these problems early so they can be addressed before the closing date.

4. How to Ensure a Smooth Transaction

Working with an experienced title company like The Title Link ensures potential issues are identified and addressed early. By carefully reviewing title commitments and resolving concerns proactively, real estate agents and lenders can help ensure a seamless closing process for their clients.

For more information on how to easily navigate the closing process, give us a call at 239-423-5465 or email us at info@thetitlelink.com