Title Tips for Buyers – Spring 2025

Spring is here, and with it comes one of the busiest home-buying seasons of the year! As buyers flood the market, Realtors and Lenders play a crucial role in ensuring smooth transactions. The Title Link is another key factor in that process.

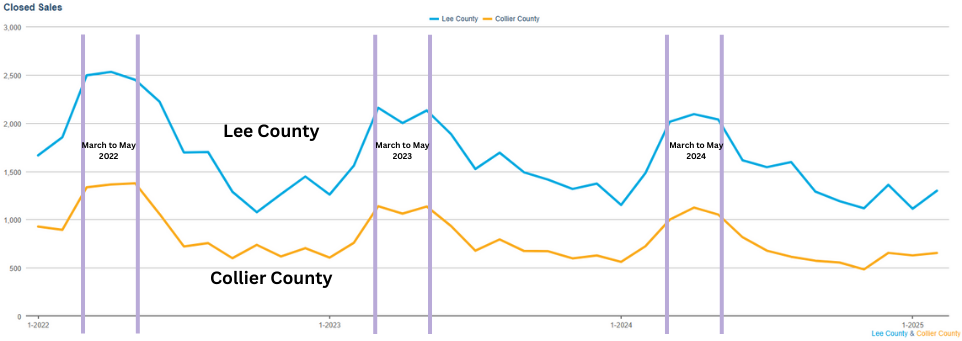

Statistics pulled from InfoSparks on 3/19/2025

Why Title Insurance Matters to Buyers

Title insurance protects homebuyers and lenders from potential ownership disputes, unpaid liens, and other title defects that could arise after closing. Without it, buyers could face costly legal battles over ownership rights.

Common Title Issues to Watch For

The Title Link searches all records to reveal potential issues in Real Estate transaction. We catch them early so any problems can be rectified by the seller before closing. Here are some common potential issues:

- Liens and unpaid debts – Previous owners might have unpaid taxes or contractor bills attached to the property.

- Errors in public records – Misspellings, incorrect legal descriptions, or clerical errors can delay closings.

- Unknown heirs – If a property has a complex ownership history, an undiscovered heir could claim ownership after the sale.

How Realtors and Lenders Can Help

- Educate buyers early – Ensure they understand the necessity of a title search and title insurance.

- Work with a trusted title company – The Title Link conducts thorough searches to catch potential issues before they become deal-breakers.

- A proactive approach keeps transactions on track. We stay in constant communication with all parties to keep a smooth transaction flow.

At The Title Link, we help you protect your transactions and keep closings moving forward. Have a client with questions about title insurance? Let’s connect! info@thetitlelink.com // 239-423-5465